A Brief Introduction to eNACH Registration & Electronic Mandates

eNACH (Electronic National Automated Clearing House) is a system in India that enables individuals and organizations to automate recurring payments. It eliminates the need for paper-based mandates and physical signatures by authorizing deductions of a specific amount directly from bank accounts at regular intervals. Managed by NPCI (National Payments Corporation of India), eNACH electronic mandate streamlines the process with easy eNACH registration, making it convenient and efficient for paying utility bills, loan EMIs, insurance premiums, mutual fund investments, and more.

eNACH has made recurring payments more convenient and efficient by reducing paperwork and streamlining the authorization process. It has gained popularity as an alternative to traditional methods like issuing post-dated cheques or setting up standing payment instructions.

Business organizations can implement NPCI-compliant eNACH mandate solutions to automate and simplify payment processes by streamlining eNACH registration for seamless recurring payment authorization.

Payment Collection: Challenges Faced by Businesses

While eMandate, such as eNACH, offers convenience in collecting recurring payments, businesses may still encounter certain challenges. Here are a few of the most common obstacles:

- Customer Authorization: Gaining customer eMandate authorization can be challenging due to customers’ hesitation in sharing bank account details for automatic deductions. Completing all information in the eMandate form is crucial, and linking Aadhaar to the bank account is mandatory per Reserve Bank of India guidelines. Businesses must implement robust authentication and verification mechanisms to ensure valid consent and prevent unauthorized mandates.

- Customer Bank Account Changes: Managing customer account changes for eMandate can be time-consuming. Tracking and updating account details may require additional communication with customers.

- Technical Integration: Integrating eMandate functionality into existing business systems and processes can be complex. It may require coordination with payment service providers, banks, or third-party platforms to ensure smooth implementation and compatibility.

- Regulatory Compliance: Ensuring compliance with regulatory frameworks and staying updated with the latest regulations and evolving data protection requirements can be challenging for businesses in the eMandate process.

- Transaction Failures and Reconciliation: Mitigating transaction failures in eMandate is crucial as NACH limits transactions to one lakh rupees daily. Technical issues or insufficient funds can disrupt cash flow and consume reconciliation and customer grievance handling time. Businesses must implement robust systems to manage failed transactions, refunds, and dispute resolution efficiently.

Overcoming these challenges requires strategic planning, robust technology infrastructure, and effective customer communication. Businesses should invest in educating customers, implementing secure and user-friendly systems, and maintaining compliance with applicable regulations to leverage the benefits of eMandate for payment collection fully.

How to Sign-Up for eNACH Registration?

eNACH offers three mandates: API Mandate, Aadhaar-based eMandate, and Physical Mandate. These Nach variants differ based on how they’re registered.

- API Mandate – API Mandate collects data automatically, directs users to the NPCI ONMAGS portal for confirmation, and the mandate data is forwarded to the customer’s destination bank. Customers then authenticate the mandate by entering their debit card or NetBanking information at the destination bank.

- Aadhaar-based eMandate – In the Aadhaar-based eMandate, registration occurs after Aadhaar OTP authentication. Users input their information on the mandate provider’s portal, agree to link Aadhaar records and receive an OTP on their Aadhaar-registered mobile number for authentication. After authentication, mandate details are forwarded to NPCI, the customer’s destination bank, and the e-mandate provider to display the Aadhaar mandate status.

- Physical NACH – In physical mandates, clients fill out a form with mandate information manually or scan it at the customer’s bank. EMandate service providers use OCR-based or QR-based document scanning to extract information and submit it to NPCI and the destination bank for verification.

For more information about which eNach variant to choose for your business, read our article on Aadhaar vs. API mandate.

A Step-by-Step Guide to the eNACH Registration Process

The eNach registration process can be completed in a number of ways; the quickest and most convenient way involves using the API eMandate variant.

Alternatively, businesses can integrate with the Aadhaar mandate or physical mandates. The latter is an attractive option for lenders operating in semi-urban or rural areas.

Read our case study on how leading rural lenders optimized loan cycles with physical mandates & QR codes to learn more.

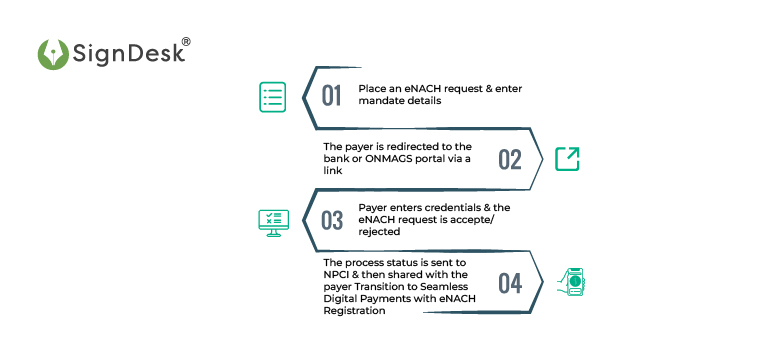

Here are the steps for eNach registration using API mandates.

Step 1. Place an eNACH request & enter mandate details

The corporate entity places an API request to send the eNach request to the customer. The eNach service provider auto-fills the mandate information in the Nach form.

Step 2. The payer is redirected to the bank or ONMAGS portal via a link

The customer receives a link to the NPCI ONMAGS portal or their bank’s website, where they can preview their mandate details and proceed for validation.

Step 3. Payer enters credentials & the eNACH request is accepted/rejected

The customer enters their debit card/NetBanking details to authenticate the eMandate. This information is relayed to the customer’s bank, where it is accepted or rejected.

Step 4. The process status is sent to NPCI & then shared with the payer

The status of the mandate is shared with both the customer and the corporate entity. If the mandate is rejected, the corporate entity can place another API request to re-initiate it; if accepted, the requested funds are transferred periodically following additional factor authentication.

Transition to Seamless Digital Payments with eNACH Registration

The advancement in digital payment solutions facilitates the adoption of a cashless economy, allowing businesses from various industries to embrace the convenience and benefits of electronic transactions.

- Streamlined Payment Collection: eMandate simplifies recurring payment collection, ensuring secure and instant digital transactions. It streamlines financial transactions, enhancing efficiency and profitability for businesses.

- Improved Cash Flow: With eMandate, businesses can experience improved cash flow as payments are automatically deducted from customer accounts on specified dates. This reduces delays in payment processing and ensures timely receipt of funds.

- Enhanced Customer Experience: Digital payments provide a seamless and hassle-free payment experience, eliminating customers needing to remember due dates, manually initiate transactions, or stand in queues. They offer faster and more convenient options than traditional methods like cash and cheques, providing a seamless payment solution.

- Cost Efficiency: Digital payment systems offer cost savings for businesses by eliminating physical paperwork, postage, and manual processing. They reduce operational expenses eliminating processing and fund transfer charges associated with traditional methods. A fixed subscription to payment gateway service providers ensures cost efficiency for businesses.

- Automated Salary Payments: Automating salary payments through eNACH and eMandate enhances efficiency and ensures timely employee compensation. This automation enhances work efficiency and reduces the time and cost associated with manual salary disbursals. With robust security measures, such as encryption and authentication, these systems safeguard customer data and mitigate the risk of fraud or unauthorized access.

- Transaction Transparency: Digital transactions offer transparency, capturing detailed information for clear payment records. eNACH is a scalable solution accommodating growing customer bases and payment volumes. It provides flexibility in payment frequency and customization options. Automating payment processes minimizes errors, improves efficiency, and ensures accurate financial data for easier tracking and management of transactions.

Overall, digital payment methods enable businesses to improve operational efficiency, enhance customer satisfaction, and achieve cost savings, ultimately contributing to their growth and success in an increasingly digital world.

eNach Registration – Enable Automated Recurring Payments Today

SignDesk is a SaaS-based software provider that offers comprehensive digital solutions. SighDesk’s NPCI-compliant eMandate automation tool, “link.it” offers solutions for mandate administration, covering NPCI versions, eNACH registration, fund collection, and payment.

Customers can securely authenticate e-mandates online using debit cards, NetBanking, or Aadhaar eSign. The smart dashboard facilitates mandate management, tracking, and transaction history. With e-mandates, businesses can scale payments, automate efficiently, and cut operating costs.

Schedule a free demo to experience the benefits of SignDesk’s leading eNACH e-mandate automation solution.